5 Highlights From Money20/20 USA 2025.

Money20/20 USA remains one of the few places where the entire fintech ecosystem actually comes together. With more than 10,000 fintech professionals in attendance every year from across the globe, it’s the place to see firsthand what’s gaining traction, who’s making moves and how leaders are thinking about the future — and this year was no different.

From AI and fraud to the evolving payments landscape, conversations across the show floor echoed the same themes shaping boardrooms and product roadmaps industrywide.

Here are five highlights from Money20/20 USA 2025.

1. AI took center stage, but with a focus on practicality and risk

AI dominated discussions, but with a tone that felt more grounded than in previous years. Rather than staying high-level or hypothetical, speakers drilled into what it actually takes to deploy AI responsibly: secure data flows, clear governance frameworks and models that can be explained to regulators and customers.

Across those conversations, one point kept surfacing: the headline isn’t AI itself anymore — it’s the infrastructure and guardrails around it. That framing underscored just how intertwined AI and fraud prevention have become. Companies were candid about the dual reality: AI speeds up innovation, but it also raises the stakes, making identity verification, onboarding, anomaly detection and behavioral analysis even more essential.

Leaders also acknowledged what many fintech teams are experiencing in practice. Early ROI from generative AI has been uneven — not because the technology falls short, but because it still requires careful oversight. Teams must refine prompts, verify outputs, stress-test models and, ultimately, figure out where AI genuinely saves time versus introducing additional steps.

Taken together, the message was clear: AI is advancing quickly, but meaningful results still depend on strong foundations — disciplined processes, quality data and people who know how to apply the technology responsibly.

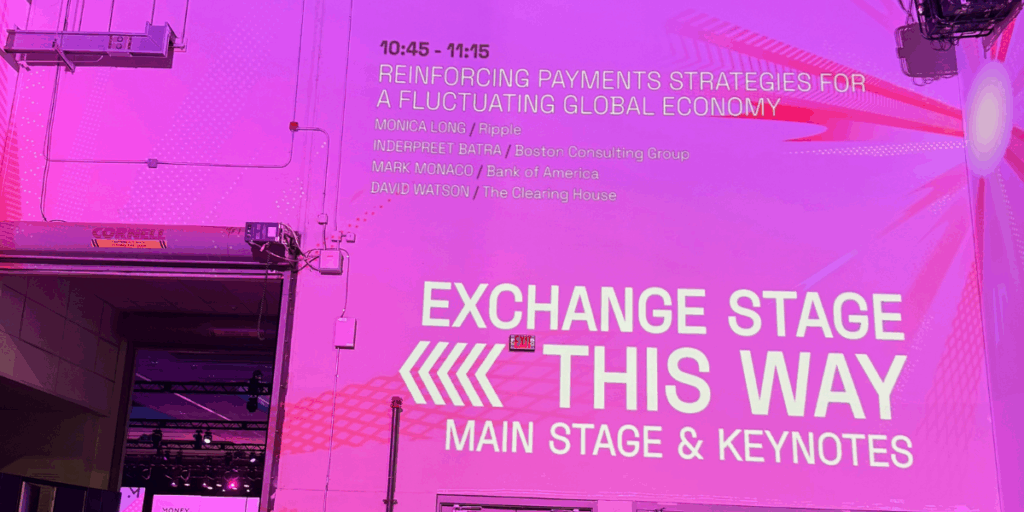

2. Payments were everywhere

It wasn’t just AI, though, that dominated the conversation. Payments had a significant presence across the conference, from real-time rails to infrastructure upgrades to fraud mitigation. Many companies echoed a shared pressure: customers expect funds to move instantly and reliably, and that expectation doesn’t leave much room for error.

Beyond speed and reliability, collaboration emerged as a major part of the payments story. The conversation was less about how fintechs can replace incumbents and more about how they can partner with them — whether regional banks or infrastructure providers — to scale responsibly and bring new capabilities to market faster. Several conversations referenced hybrid models, shared rails or ecosystem partnerships that make it easier to support real-time movement of money without compromising compliance.

Stablecoins also appeared frequently in conversations this year, particularly in the context of cross-border payments and modernizing global transfers. While still early in many respects, their growing presence reflected a broader interest in diversifying payment flows and reducing settlement friction.

Across the board, leaders emphasized the same core point: payments remain one of the most active and competitive parts of the fintech landscape, and the pressure to improve speed, trust and interoperability is only growing.

3. Networking extended beyond the agenda

Money20/20 has never faced a shortage of strong programming, and this year’s sessions, demos and panels certainly lived up to the hype. But if you were only to attend the scheduled agenda items, you’d miss a major part of what makes the week so special: the hundreds of breakfasts, meetups, happy hours and after-hours gatherings across Las Vegas and the opportunities they created.

It’s always one of the highlights of our year, and hosting it at Cañonita for the first time added a fun twist. With the backdrop of the Venetian canal, the setting made the night feel lighter and more relaxed — a perfect match for the 138 founders, investors, innovators and journalists who filled the room.

And with that, a big thank you is in order to our sponsors Morrison Foerster, Grasshopper Bank, TradeStation, Sydecar and The Financial Revolutionist for helping make it such a standout start to the week

Interested in sponsoring a future Fin & Juice event at Money20/20 or Fintech Meetup? Whether you want to get hands-on or prefer to sit back and let us take care of everything, let’s talk.

4. Companies are paying more attention to how they frame complex innovation

Another theme that stood out this year was the renewed focus on making complex products easy to understand. This isn’t a new idea — benefits-over-features has always mattered — but the conversations around fraud, identity, infrastructure and AI reflected a growing recognition of how important clear explanation has become.

Across these conversations, there was a clear effort to anchor technical topics in the real-world “why” — the challenge that exists today, the outcome teams are working toward and the impact those decisions have on customers and the broader ecosystem.

As communicators, it was encouraging to see this emphasis threaded through the week. We spend a lot of time helping clients articulate their value in ways that are relatable, memorable and clear to the audiences that matter, and it’s a reminder that clarity remains a competitive advantage, especially where complexity is the norm.

It’s not a reinvention of storytelling — it’s an acknowledgment that in a crowded and complex market, clarity has real impact.

5. In-person time remains irreplaceable

The way we work, communicate and collaborate has changed immeasurably over the past five years, making it easier for companies to hire the best talent from a larger pool, partner with teams they’ve never met in person and keep projects moving even when travel isn’t practical.

Still, there’s just no substitute for real face time.

This year, nearly two dozen of our partners were onsite at Money20/20 — some speaking, others attending — and it created space for conversations that don’t always fit into the day-to-day. Whether it was a scheduled meeting or a quick check-in between sessions, the week made it easier to reconnect and hear firsthand what teams are prioritizing as they head into 2026.

The same applied on the media side. With countless industry journalists onsite, Money20/20 USA offered meaningful chances for partners to engage — through scheduled interviews, chance conversations and those brief exchanges that only happen when everyone is in the same place.

Translation? Whether you’re looking to learn, meet prospective partners and clients, broaden your network or establish yourself as a leading voice in the fintech space, Money20/20 USA is THE place to be.

Looking ahead

Money20/20 USA 2025 reinforced why it remains fintech’s biggest annual event. Few places bring together this much talent, industry perspective and momentum in one week, and even fewer offer such direct access to the conversations shaping where financial technology goes next.

For fintech teams planning how and where to show up in 2026, events like Money20/20 remain foundational, not just for visibility, but for staying connected to what customers, partners and the broader ecosystem care about most.

If you’re thinking about how industry events fit into your broader marketing and communications strategy for 2026 — from where to show up to how to make those appearances count — we’d be happy to talk about where we see opportunities for your brand to make a splash.

Up Next.

10 End-of-Year Marketing and Communications Strategies to Build Momentum in 2026.

Read More