Making an Impact this Financial Literacy Month in Fintech and Financial Services.

This year, we observe Financial Literacy Month here at Caliber by educating our team using a variety of sources, and advocating for financial inclusion to create equity in our industry. This is a reflection of Caliber’s values and beliefs.

This year we’re also ‘shouting out’ a few companies in fintech and financial services, using their passion and resources to make an impact this Financial Literacy Month.

Here are five organizations we’d like to recognize for their passion, creativity and commitment.

Fintech Shout Outs

1. MoneyLion

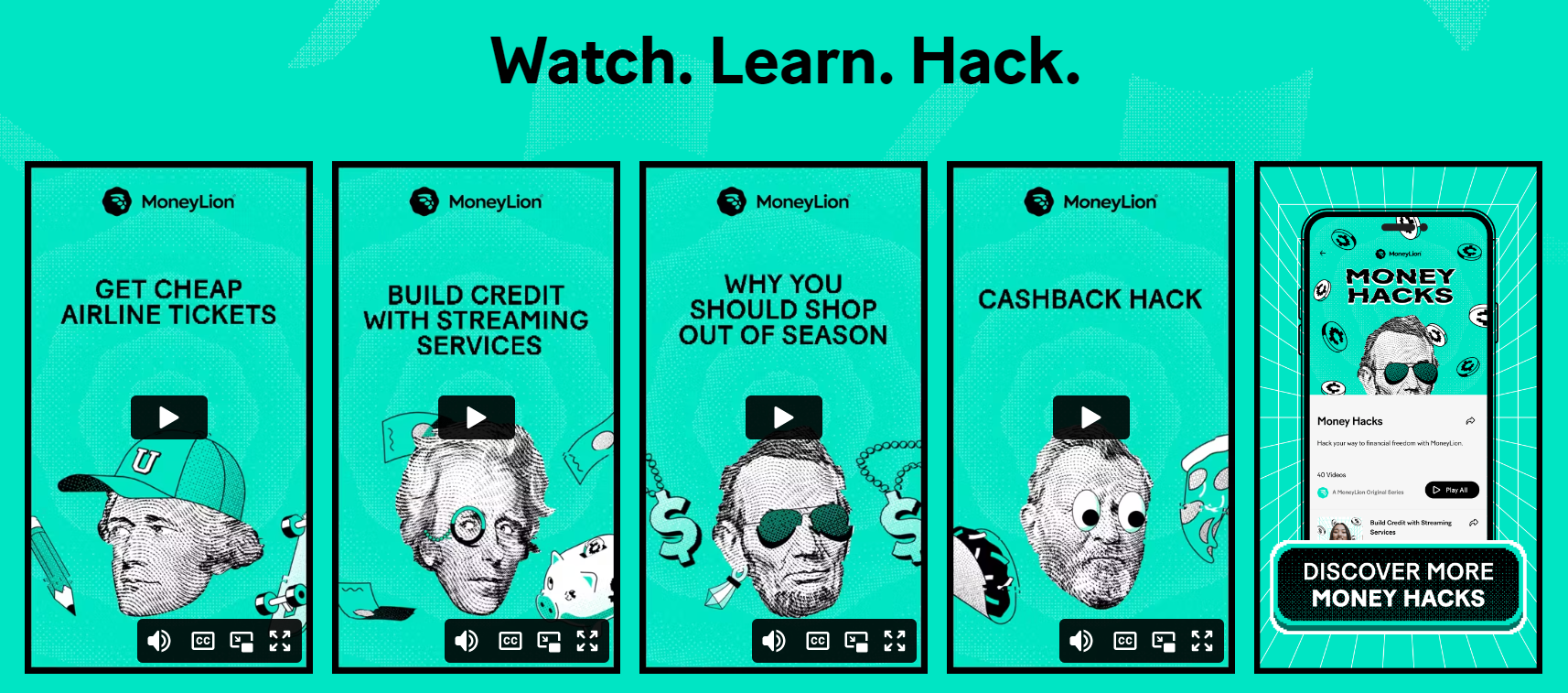

MoneyLion, a NYC-based mobile banking platform for borrowing, saving and investing, flexed their creative muscles this Financial Literacy Month with an incentivized, experiential campaign.

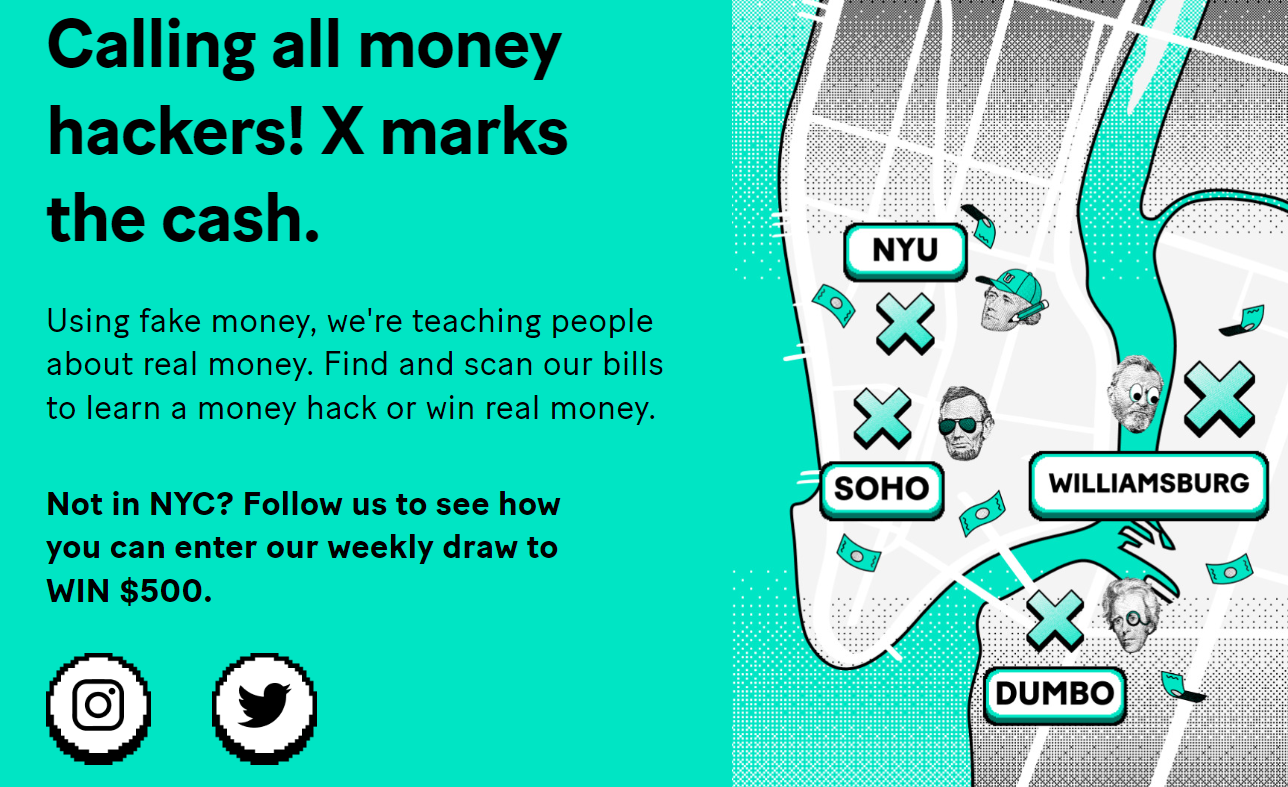

MoneyLion is known for providing customers with money-saving hacks. The creative minds at this fintech company created a way to entice and inspire New Yorkers to focus on financial literacy by placing fake $20 bills around the city. By scanning a custom QR code, users are directed to MoneyLion’s Money Hacks section of their website to access bite-sized videos chock full of quick tips on ways to save money, build credit and more.

🚨START LOOKING!🚨You could win up to $1,000. For Financial Literacy Month we put fake bills in the neighborhoods below⬇️Find them, scan the QR code on them, and see if you won money—that’s it! **This is not an April Fools Prank** pic.twitter.com/YGfmaB6xn8

— MoneyLion (@MoneyLion) April 1, 2023

2. Evolve Bank & Trust

Are you part of the 42% of Americans with less than $1,000 in savings? Visit Evolve’s Savings Resource Center for helpful tips on how to grow your savings: https://t.co/zZDy1d8dAD #FinancialLiteracyMonth #BeyondBanking #GetEvolved pic.twitter.com/DaqubZU531

— Evolve Bank & Trust (@getevolved1925) April 10, 2023

Evolve Bank & Trust, a Memphis-based financial services company specializing in payment processing solutions and banking, is on a mission to educate people about principles and tips to guide spending and saving habits for the better, including:

- 50/30/20 Budgeting

- Simple Steps to Save

- Advice for New Credit Card Holders

- What Makes up a Credit Score

- Grow Your Wealth: Learn the Basics of Savings and Investments

3. Money20/20

This NYC-based marketplace for ideas, connections, and deals in payments and financial services, asked some of the experts in their network to share their thoughts on what steps should be taken to boost financial literacy among the younger generation using LinkedIn.

Shout outs go to

- Naftali Harris of SentiLink, for sharing his tips on how to boost financial literacy among younger generations.

- Will Sealy at Summer for sharing three pieces of advice for solving the financial literacy gap for students taking on loans and navigating repayment.

- Stephany Kirkpatrick CFP® at Orum.io who spoke to how financial literacy creates the inclusion needed for everyone, especially the younger generation, to participate in the economy

- Jeremiah Glodoveza at Nium for sharing impactful ways to help families think and talk about money to start teaching children and young adults financial literacy early and often.

4. Ellevest

Sallie Krawcheck, co-founder and CEO of NYC-based Ellevest, an investing platform built with women’s needs in mind, used her LinkedIn account to share ways to model a healthy money mindset for children. Healthy habits are established early in children’s lives — and attitudes about money are no different. In fact, some research says that money habits form as early as age seven, according to Sallie.

The passion behind the Ellevest team is their focus on closing the wealth gender gap. In fact, Sallie’s post shares tips on how to model a healthy — and fair — money mindset for kids.

Here are some of Sallie’s insights and tips:

- Address unhelpful stereotypes: Things like “men make money, and women spend it.” That women are bad at managing finances. Breaking down this stereotype shows our kids that they simply are not true — and aren’t helpful to anyone.

- Talk about money, with them and others: Some parents tend to feel like they need to have perfect money habits or know all the answers before they can talk to their kids about money. But since money habits are developed so early in life, it’s important not to wait to have these conversations. Let them know you’re still learning, too.

- Choose women: Choosing women professionals and shopping at women-owned businesses on the regular provides our daughters opportunities to see women in professional roles (so that they can imagine themselves like that someday).

5. Fintech in Action (FIA)

We’d also like to place a spotlight on an organization that is doing the work year-round. Fintech in Action (FIA) is a Chicago-based action-oriented company seeking to increase the pipeline of Black professionals for careers in finance and fintech.

FIA aims to equip Black talent with access to fintech careers and a higher understanding of financial literacy. They invest in organizations that are working towards creating career pathways in financial services for young, high-achieving minority students.

Learn more about Financial Literacy Month

Each April, Americans observe Financial Literacy Month, which was proclaimed by Former President George W. Bush nearly 20 years ago as a month for U.S. citizens and organizations to focus on learning through programs and activities sponsored by the National Financial Educators Council (NFEC).

Up Next.

How to Get the

Most out of NY

Fintech Week 2023.

Read More